Buying or constructing a home is a significant milestone, but for many, it’s challenging to pay the entire cost upfront. That’s where home loans come in, offering a practical solution by allowing you to pay over time. If you’re new to the process, this guide will help you understand how home loan, the steps involved, loans and the basics of it.

What is home Loan?

A home loan is an amount that an individual can borrow from banks and other financial institutions to purchase or construct a new house or renovate or extend an existing one.

Financial Institutes that are tied up with Nammane Constructions

Types of Home Loans:

1.New Home Purchase Loan: For purchasing a ready-to-move-in home or an under-construction property. A New Home Purchase Loan in India helps you buy your dream home newly built apartment with financial ease. These loans are offered by banks and housing finance companies at competitive interest rates. You can choose flexible repayment options, usually up to 30 years, making it easier to manage monthly payments. With various schemes and government subsidies available, it’s a great way to own a home without draining your savings upfront.

2.Home Construction Loan: For constructing a new home. A Home Construction Loan in India provides funds to build your home on a plot of land. Banks and financial institutions offer these loans, disbursed in phases as construction progresses. You can choose flexible repayment terms, and interest is charged only on the amount used. This loan helps you manage construction costs step-by-step, without putting pressure on your savings, making it easier to build your home just the way you want.

3.Home Renovation Loan: For repairs, renovations, or improvements to an existing property. A Home Renovation Loan in India helps you finance repairs or upgrades to your home. Whether you’re planning to remodel a room, fix structural issues, or improve interiors, this loan covers a variety of renovation needs. Offered by banks and financial institutions, the loan comes with flexible repayment options, allowing you to spread out the cost of your renovation without tapping into your savings. It’s a simple and convenient way to give your home a fresh new look.

4.Land Purchase Loans: A Land Purchase Loan helps you buy a plot of land for building your dream home or as an investment. These loans are provided by banks and financial institutions, usually covering a significant portion of the land’s cost. With flexible repayment options and competitive interest rates, a land purchase loan allows you to secure the property without paying the full amount upfront, giving you time to plan your future construction or development projects.

5 Features of Home Loan

- By taking a Home Loan, you can enjoy the following benefits:

- Taxation :

- A home loan lets you claim tax deductions on both the interest and the principal amount. According to the Income Tax Act of 1961, you can claim up to INR 1.5 lakh for principal repayments under Section 80C and up to INR 2 lakh for interest repayments under Section 24B. There are also other tax benefits you can get through a home loan.

-

- Flexibility & Long repayment tenure :

- Home loans offer flexibility with longer repayment tenures, often extending up to 25–30 years. This allows borrowers to spread the loan amount and interest over an extended period, resulting in lower monthly EMIs and making homeownership more affordable. Additionally, many lenders provide the option to make prepayments, offering flexibility to reduce the loan burden early without penalties.

-

- No prepayment penalty

- With a floating-rate home loan, you can make prepayments whenever you have extra funds without incurring any prepayment penalty. This allows you to repay the loan faster and close it before the original tenure ends.

-

- Top – up loan facility

- A top-up facility on a home loan allows borrowers to avail an additional loan amount over and above their existing home loan. This is usually offered at competitive interest rates, lower than personal loans. The top-up loan is available only after a certain portion of the original home loan is repaid and depends on the borrower’s repayment history and property value.

-

- Balance transfer facility

- A home loan balance transfer allows you to refinance your existing loan with another bank offering lower interest rates or more favorable terms. This can help you secure better financial conditions on your loan.

Pradhan Mantri Awas Yojana – Urban – PMAY(U)

Pradhan Mantri Awas Yojana (PMAY), launched on 1 June 2015, is a government-backed initiative to provide affordable housing for the urban poor. Households with annual incomes between INR 3 lakh to 18 lakh can apply, provided they or their family members do not own a pucca house anywhere in India. PMAY operates under the Credit Linked Subsidy Scheme (CLSS), offering beneficiaries an interest subsidy on loans for purchasing or constructing a new house. Beneficiaries cannot avail of the scheme for previously constructed buildings.

Click here to know more about Pradhan Mantri Awas Yojana

Home Loan Eligibility Criteria

- To qualify for a home loan, you generally need to meet the following basic criteria:

- Age: Salaried individuals should be between 23 to 65 years, while self-employed professionals should be between 23 to 70 years.

- Income: Your monthly income must be at least Rs. 20,000 or higher, though this varies by bank and location.

- Employment Status: You can be either salaried or self-employed.

- Credit Score: A credit score of 750 or above with a solid credit history is required.

- Loan-To-Value Ratio: You can borrow up to 90% of the property’s value.

- Work Experience: At least 2 years of work experience is needed.

- Residence: You must be a permanent resident or a Non-Resident Indian (NRI).

Each bank in India has its own eligibility criteria for home loans, so the requirements may differ slightly between lenders.

Calculate your home loan eligibility here

Documents Required for Home Loan

1. For Salaried Individuals:

For identity proof

- Aadhaar Card

- Passport

- Voter ID or any other government issued ID

For address proof

- Utility bills

- Passport

- Aadhaar Card or Voter ID

Occupancy documents

- Sale deed

- Title deed

- Approved building plan

Others

- Form 16, Salary slips of last 3 months and Bank statements of last 6 months

- Recent passport size photographs

- Duly filled and signed loan application form

2. For Self-Employed Individuals:

For identity proof

- Aadhaar Card

- Passport

- Voter ID or any other government issued ID

For address proof

- Utility bills

- Passport,

- Aadhaar Card or Voter ID

Company Documents

- Audited financial statements of last 2 years

- Balance Sheets

- Profit & Loss Statements.

- ITR documents

- GST registration,

- Trade license

- Partnership deed

- Articles of Association

- SEBI registration certificate

- ROC registration certificate

Others

- Bank statements of last 6 months

- Recent passport size photographs

- Duly filled and signed loan application form.

Steps to Apply for a Home Loan

Step 1: Determine Your Loan Eligibility

Use an online eligibility calculator offered by banks to estimate how much loan you can get based on your salary, age, and other factors.

Step 2: Choose the Right Lender

Compare interest rates, processing fees, and customer service reviews of various banks or housing finance companies.

Step 3: Prepare Documentation

Identity Proof: Aadhaar card, PAN card, passport.

Income Proof: Salary slips, bank statements, IT returns.

Property Documents: Sale agreement, title deed.

Employment Proof: Offer letter, employment certificate.

Step 4: Submit Application

You can apply either online or by visiting the lender’s branch. Submit your documents and wait for verification and approval.

Step 5: Loan Sanction & Disbursement

After verification, the lender sanctions the loan. The funds are disbursed in stages (especially for under-construction properties) or fully if the property is ready to move in.

Home loan Interest Rate in India

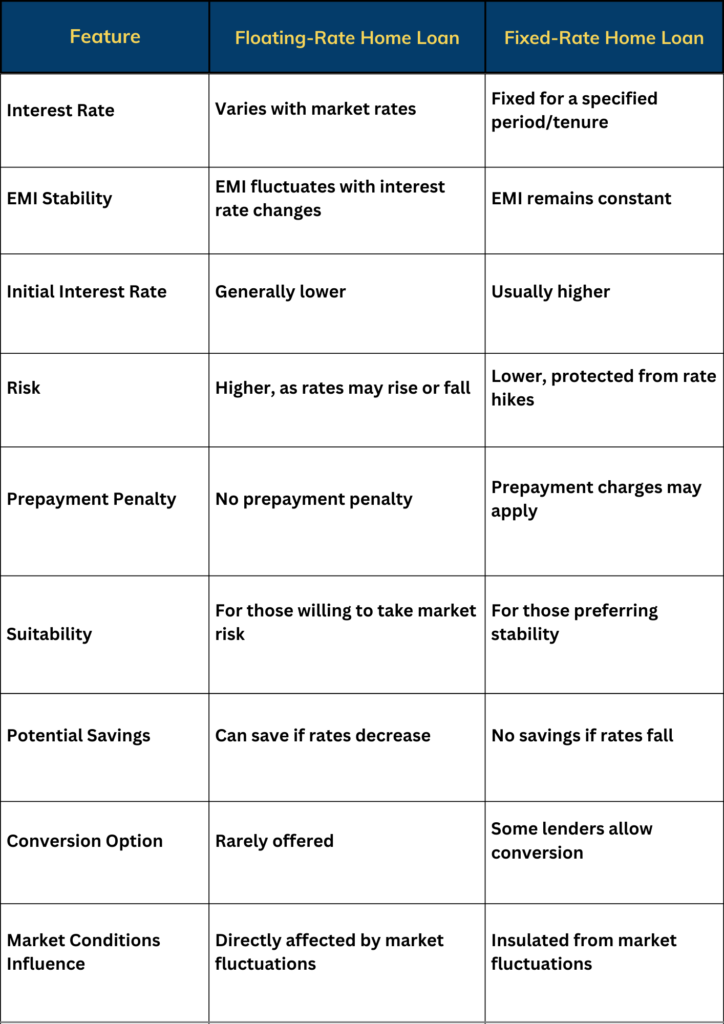

Which One to Choose?

Choose Floating-Rate Home Loan if you’re comfortable with risk and expect rates to fall, which could reduce your EMIs.

Choose Fixed-Rate Home Loan if you want stability in EMIs and prefer predictable payments, especially in a rising interest rate environment.

Things to Keep in Mind While Applying for a Home Loan

- Borrowing Capacity: Don’t take a bigger loan just because you earn more. First, figure out your monthly expenses—household bills, travel, kids’ fees, loans, and utilities. What’s left over is what you can afford for EMI payments.

- Credit Score: A good credit score (750 or above) is key to getting a lower interest rate on your home loan. Lenders are more likely to offer better terms if you have a high score.

- Loan Tenure: Home loans can stretch up to 30 years. Review the loan term carefully and see if it works for you. If needed, negotiate a longer tenure or lower the loan amount.

- Terms and Conditions: The loan agreement is legally binding, so read all terms, conditions, and clauses carefully before signing to avoid hidden issues. Always make well-informed decisions when buying a home.

Home Loan FAQs

What is 80 20 rule home loan?

The 80:20 home loan scheme allows you to buy a home by paying just 20% upfront, while the remaining 80% is covered by a bank loan. For under-construction properties, the builder covers the interest on the loan until the property is handed over to you. This setup reduces your initial down payment and makes it easier to own a home compared to traditional loans that require 25% or 30% upfront.

At what salary I should take home loan?

To take a home loan in India, your salary should allow you to comfortably manage EMIs, which should ideally not exceed 40-50% of your monthly income. Lenders usually approve loans up to 60 times your monthly salary, so a higher income provides better eligibility. Ensure you also account for other financial commitments and maintain an emergency fund before committing to a home loan.

How much home loan I can get on Rs 50,000 salary?

With a salary of ₹50,000 per month, you can typically get a home loan where the EMI is about 40-50% of your income, i.e., ₹20,000-₹25,000 per month. Based on this, lenders might offer you a loan of around ₹25-35 lakh, depending on the loan tenure, interest rates, and other financial obligations.

Calculate your Home Loan EMI Here

Conclusion

Taking a home loan is a big decision and requires careful financial planning. By understanding your eligibility, comparing loan options, and considering factors like interest rates and loan tenure, you can make a well-informed decision. Always ensure you’re comfortable with the EMI payments and maintain a good credit score to get the best possible deal.

With the right loan, buying your dream home can become a smooth and achievable goal. Here’s to finding your ideal home!”